What is compound interest?

Re-investing of your earned interest is called “compounding interest”.

Each month you earn interest on the amount you have invested. The amount you have invested remains the same, and so each month you earn the same amount of interest.

However, re-investing that earned interest each month increases your investment amount for the remaining period, earning you more interest the following month. This re-investing of your earned interest is called “compounding interest”.

Here at Kuflink, we have created an algorithm that mimics the effect of compounding interest. The compound interest is based on a calculation that becomes payable upon a triggering event involving capital reduction. These cases include partial (pro-rata basis), full repayment or sale on the secondary market.

You can now compound interest at the click of a button. Compound interest is an incredibly powerful way to grow your investment and roll over interest to receive a larger return when your investment matures*.

Representative example

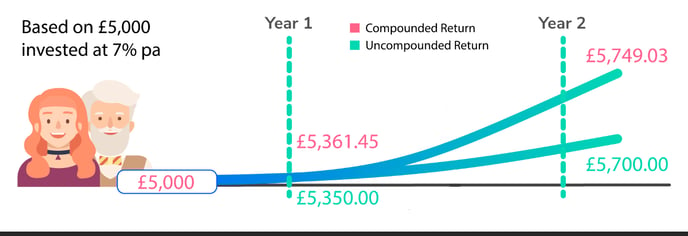

A £5,000 investment at 7% pa over a 2-year period would return £5,749.03 compounded or £5,700 uncompounded*.

Lender/Investor Risk Warning

*Don’t invest unless you’re prepared to lose money. This is a high-risk investment. You may not be able to access your money easily and are unlikely to be protected if something goes wrong. Take 2 mins to learn more.