- Help Center

- Products

- Select Invest

-

AML Checks

-

Corporate Investors

-

Type of Investors in P2P agreements

-

Appropriateness Test APT

-

Top Up

-

FSCS

-

New Investor Cashback

-

Products

-

IF-ISA

-

Peer-to-Peer Investing

-

Account Setup

-

Portfolio

-

Account Overview

-

Default Rate

-

Compound Interest

-

COVID-19

-

Borrowing

-

Deceased Investor

-

Legal Power of Attorney

-

Kuflink Glossary

-

Wind Down plan

-

Platform Availability

-

Modern Slavery Statement

-

ESG

-

Affiliate

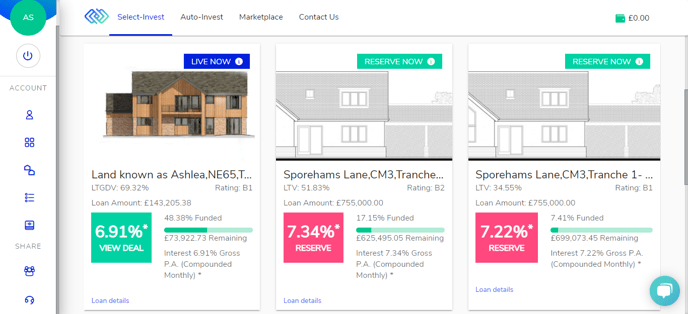

What is the difference between a 'live' and a 'reserve' deal?

Once you have selected the 'Select Invest' option you will see all the available loans to invest in. There are two types of deals you can invest into, 'Live Deals' and 'Reserve Deals'.

Live Deals

These are previously reserved loans that are now completed (i.e. we have paid out the funds to the borrower).

Reserve Deals

These are new loans that we have agreed for borrowers but have not yet completed (i.e. we have not paid out funds to the Borrowers), that we place onto the platform for investors to fund.

For each day your funds are held in a Reserve deal, you will earn cash-back that will be paid once the deal goes live!

The cash-back amount will be equal to the interest from the date you put the funds into the Reserve deal to the date the deal goes live, so you don’t lose out.

See Reserve Deal Section in Investor Terms & Conditions